Manufacturing plastic products from recycled plastic

Manufacturing plastic products from recycled plastic

Thailand is strengthening its role as a leading global hub of plastics manufacturer, with makers placing greater emphasis on value-added and environment-friendly products. The Thai plastics industry is growing consistently, and demand in the vigorous domestic economy is the key driver.

To promote sustainable growth in the plastics industry together with protection of the environment, the BOI classifies projects in the manufacture of eco-friendly plastics as priority activities of special importance to the country. Therefore, these are given maximum investment incentives.

The only condition that a business needs to follow in order to become a manufacturer for plastic products from the recycled plastics is that it must have plastic forming process using domestic plastic raw materials only.

The incentives that can be given to this project are those under A4 category which includes:

- 3 years of corporate tax exemption

- Exemption of import duties on machinery

- Exemption of import duties on raw materials used in the production for exports

- 100% foreign business ownership

- Permit to own land

- Permit to bring skilled workers and expert to work into the Kingdom.

If you are planning to register your business in Thailand, please do not hesitate to contact MSNA for more information. We are experienced in BOI application, setting up a company, getting Foreign Business Certificate, visa and work permit application.

Opening a Business in Thailand

Opening a Business in Thailand

Do you want to open a company in Thailand but don’t really know how to proceed or the process might seem difficult? Do not worry, we at MSNA can give you the best solution.

The procedures depend on the type of company that you will set up. Let’s discuss it in details.

A. Registering a Thai company with 51% shares held by Thai shareholder

Pros:

- Your company can do business right after registration.

- The process is much easier because you don’t need to get special license.

Cons:

- If you want to hire foreigners to work, your company must have 2 million Baht capital and hire 4 Thai employees in order to apply for one work permit.

How to register:

- You need at least 3 shareholders (if you have 2 foreigners, then you need 1 Thai).

- The number of shares to be held by Thai must be at least 51%. This Thai shareholder must show proof of funds (at least 6 months update of bank statement showing enough money to buy the amount of shares they will hold).

- Please read the steps here

B. Other options:

If new Thai limited company will be doing only export activities from Thailand or manufacturing goods in Thailand, then it can be foreign majority owned without obtaining a Foreign Business License.

- Get BOI certificate (Board of Investment)

Pros:

- It would be fine if you don’t have a Thai partner as long as your business activity falls under any category of eligible activities for BOI promotion.

- Tax exemption such as corporate income tax, tariff exemption or reduction on import machinery and raw material (depending on the company’s activity).

- Non-Tax privileges such as permission to own land, permission to bring foreign expert to work on the promoted projects, exemption on foreign ownership of companies and exemption from work permit and visa rules.

Cons:

- Not all activities are eligible to obtain a BOI certificate. Please checkout Foreign Business law here

- If your company’s activity is not in this list, you will need to get Foreign Business License.

How to register:

- The process to get BOI is summarized here

Registering a business in Thailand can be troublesome but we at MSNA can make it convenient for you. Contact us now for initial consultation.

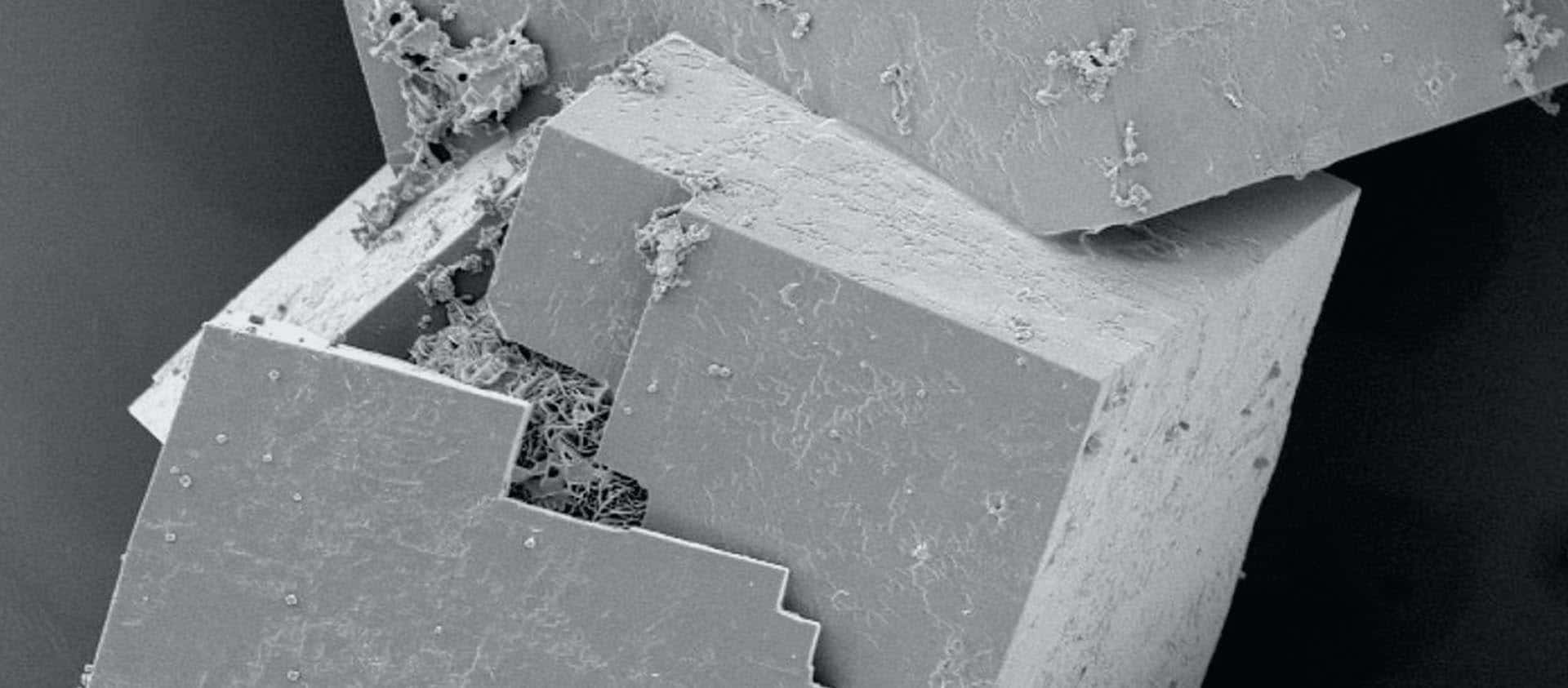

Manufacture of Hard Disk Drive

Manufacture of Hard Disk Drive

Since the last decade, Thailand has been the biggest manufacturer of hard disk drives. Thailand offers low cost, literate, high quality labour and national infrastructure that facilitates the export market. The big digital companies are now manufacturing their products in Thailand to take advantages of these benefits. Some of the conditions and incentives that could help you are listed below.

BOI Activity 5.4.6 Manufacture of hard disk drive

Conditions:

– The areal density of hard disk drives must not be less than 2,000 gigabits per square inch.

– The cost of refurbishment of existing machines shall be regarded as an investment and will be taken into account in the calculation of corporate income tax exemption cap. The original cost of existing machines shall not be regarded as an investment.

Incentives:

- An exemption of corporate tax for 8 years.

- Exemption of import duties on machinery

- Exemption of import duties on raw materials used in production for export

- 100% foreign ownership

- Permit to own the land

- Permit to bring skilled workers and experts into the Kingdom

Get in touch with us so we can help you set up your BOI Company in Thailand.

Thailand SMART Visa

Thailand SMART Visa

On 1 February 2018, a new visa was launched in Thailand which is known as the SMART Visa. This Visa was introduced to attract new talents and technologies in order to further develop the targeted industries. The SMART Visa program is designed to enhance Thailand’s attractiveness in drawing science and technology experts, senior executives, investors and start-ups. The SMART Visa focuses investment on the “10-S Curve Industries” or the country’s targeted industry.

The 10-S Curve industries or the targeted industries include:

- Next generation automotive

- Smart electronics

- Affluent, medical and wellness tourism

- Agriculture and biotechnology

- Food for the future

- Automation and robotics

- Aviation and logistics

- Biofuels and biochemical

- Digital

- Medical hub

The SMART Visa has five different categories that a person can apply for:

- SMART “T” Visa is for highly skilled professionals in the science and technology aiming to work in the targeted industries

- SMART “I” for investors in companies using technology in manufacturing or delivering services of being in the targeted industries.

- SMART “S” for foreign start-up entrepreneurs who wish to invest in the targets industries in Thailand.

- SMART “E” for senior executives working the companies using technology and manufacturing or delivering services and being in the targeted industries.

- SMART “O” for spouse and children of SMART visa holders.

In order to be eligible, applicants must obtain a qualification endorsement letter from the SMART Visa Unit. During the process, applicants will also need to go through a technical endorsement screening by the designated agencies after which a letter will be issued by the Thailand Board of Investments which the applicants use in order to apply for their SMART Visa.

The benefits of applying a SMART Visa instead of any other type of visa are:

- The visa is valid for 4 years instead of the usual 1 year.

- There is no requirement of work permit

- Spouse and children will have the same rights as the SMART Visa holder in Thailand (only SMART T Visa allows the dependents to work in Thailand)

- Extension of Visa (annual reporting instead of 90 days)

- No re-entry permits

To see if you are eligible to apply for Thailand SMART Visa, contact us for initial consultation.

Thailand Investment Promotion for Software Park Business

Thailand Investment Promotion for Software Park Business

As the digital way of life has now been touching all corners of the Thai society, the software industry is a very crucial driver for the country’s technological, social and economic development. With a very competitive market, Thailand is a very attractive software investment location for its skilled and affordable workforce, with programmers with a strong suit. If you are planning to invest in a Software Park business in Thailand, then the conditions and incentives below might help you.

Conditions:

- Project must have high-speed fibre-optic main communication system throughout the area.

- The main telecommunication system must have a high-speed cable from the software park to domestic and international telecommunication centre.

- Continuous back-up of electricity supply must be installed.

- The total area must not be less than 5,000 square meters.

Incentives to set up a software park in Thailand promoted by the board of investment are:

- An 8 year exemption from corporate income tax

- Exemption of import duties of machinery such as computers and software

- Exemption of import duties on raw materials used in production for export

- 100% foreign ownership

- Permit to own the land

- Permit to bring skilled workers and experts to work in Thailand.

For further queries, please feel free to read the Thailand BOI information and contact MSNA to help you with your BOI company registration.

Audit for BOI promoted companies

Audit for BOI promoted companies

Companies in Thailand need to file their audited financial statements within 1 month after their Annual General Meeting (AGM) of shareholders. An AGM must be held by 4 months after the accounting year-end to approve the financial statements. BOI promoted companies need the statutory audit every year like their non-BOI counterparts.

Moreover, the BOI companies that are granted a corporate income tax exemption right can exercise that right in the year that they have profits only after they have complied with the conditions specific to their promoted projects. In filing for the BOI’s approval to exercise such right, they need a Thai CPA to audit their BOI operation to make sure that they have complied with the all conditions set out by the BOI. This auditor can be a different person from the one that performs the statutory audit for the company.

Filing the statutory audited financial statements must be done for every accounting year even when the company was just set up and the whole fiscal period has not completed 1 year. Fiscal year-end depends on the company’s policy. But once chosen, it cannot be changed without the approval of the Director General of the Revenue Department.

Audit for BOI companies has difference procedures than non-BOI companies. Contact MSNA Group for audit services.

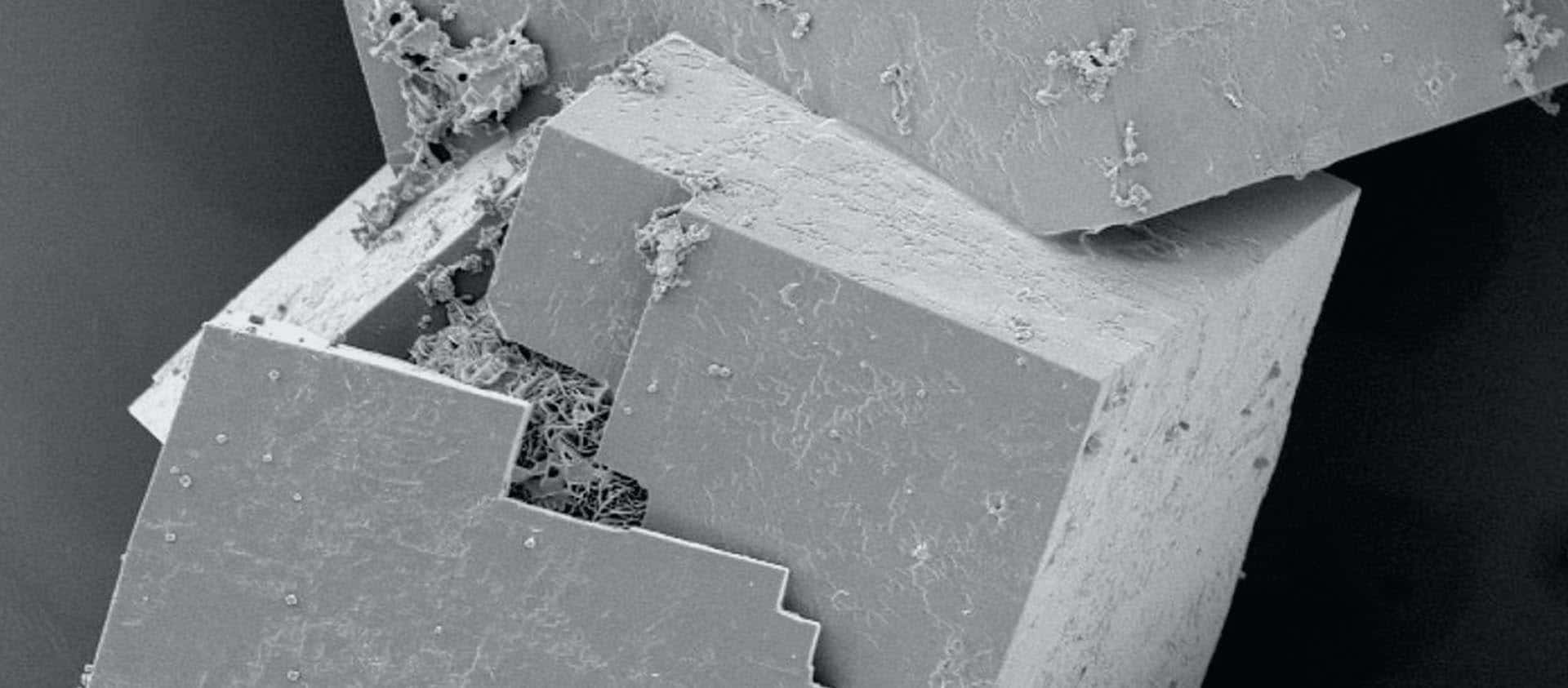

BOI Promotion for Nanotechnology Development

BOI Promotion for Nanotechnology Development

Thailand Board of Investment sees the crucial benefits to Thailand in promoting the nanotechnology industry. If your business can meet these conditions, it is definitely worthwhile to pursue the BOI application.

Conditions:

- Target technology development procedures shall be used as a base for the manufacturing process or service provision in the target industry as approved by the BOI.

- There must be a technology transfer with an educational institution or research institute as approved by the BOI e.g. Technology Research Consortium.

- Project located in a science and technology park promoted by the BOI or one that is approved by the Board will receive an additional 50 percent reduction in a corporate income tax for 5 years after the end of its corporate income tax exemption period.

- Project may apply for merit based incentive and be granted the corporate income tax exemption for not exceeding 13 years.

- Project shall be granted import duty exemption on goods.

Here are the benefits of getting BOI promotion for your business in the nanotechnology industry

- Exemption from corporate income tax for 10 years without cap on the income tax you can save.

- Exemption of import duties on new machinery that you may need to import for your new business.

- Exemption of import duties on raw materials used in production for export.

- 100% foreigner ownership of your business

- Your BOI promoted company can own land that you will use only for your promoted business activity.

- Your company will be able to get a lot of work permits for your skilled workers and experts.

MSNA Group can help you set up your BOI company in Thailand with ease. Talk to us today.

BOI Promotion for Manufacture of Medicine

BOI Promotion for Manufacture of Medicine

Thailand Board of Investment offers incentives and benefits for businesses within the medicine manufacturing industry. In order to qualify for the benefits, medicine manufacturing operations must meet certain conditions as set forth below.

The BOI conditions and incentives are summarized below:

- For conventional medicine projects, such promoted projects must achieve GMP standard prescribed by PIC/S within two years from the full operation start-up date.

- For traditional medicine projects, such promoted projects must achieve GMP standard within two years from the full operation start-up date.

- For the improvement of existing projects, existing machinery can be used in the promoted project but its value shall not be included in the investment amount eligible for corporate income tax exemption.

- Incentives are A3 category:

- Exemption from corporate income tax for 5 years.

- Exemption of import duties on new machinery.

- Exemption of import duties on raw materials used in production for export.

- 100% foreigner ownership.

- Permit to own land.

- Permit to bring in skilled workers and experts to work in the Kingdom.

Let MSNA Group help you in setting up your BOI company in Thailand.

BOI Promotion for Manufacture of Metal Products or Metal Parts

BOI Promotion for Manufacture of Metal Products or Metal Parts

The Board of Investment provides incentives and benefits for doing business in Thailand within the metal manufacturing industry. In order to qualify for the benefits, the project must have metal forming process continuing from iron/steel casting process (using induction furnace) or iron/steel forging process, i.e. machining and stamping within the same project. Incentives for doing business in the manufacturing of metal products or parts includes corporate income tax and import duty exemptions.

The BOI incentives granted to the business of Manufacture of Metal Products or Metal Parts are summarized below:

- Exemption from corporate income tax for 5 years.

- Exemption of import duties on new machinery.

- Exemption of import duties on raw materials used in production for export.

- The company can be owned 100% by foreigners.

- You can own land enough for your business use.

- Getting many work permits for your skilled expat employees.

Let’s discuss your Thailand’s business plan today. Contact MSNA Group for expert advice in setting up your BOI company.

BOI Promotion for Plant or Animal Breeding

BOI Promotion for Plant or Animal Breeding

The BOI provides incentives and benefits for doing business in Thailand within the plant or animal breeding industry. This incentive aids those companies that are not eligible for biotechnology activity. In order to qualify for the benefits, plant or animal breeding operations must meet certain conditions as set forth below.

The BOI conditions and incentives are summarized below:

- Projects must have research and development activities.

- For breeding of sensitive plants according to the policy of the Ministry of Agriculture and Cooperatives, projects must have Thai nationals holding shares not less than 51 percent of the registered capital.

- Projects must have expenses for salaries for R&D personnel of at least 1,500,000 baht per year.

- Projects located in the science and technology park promoted by BOI or one that is approved by the Board will receive an additional 50 percent reduction of corporate income tax for 5 years after the end of its corporate tax exemption period.

- Revenue derived from plant propagation after plant breeding in the project shall be regarded as revenue of promoted projects, except for the propagation of cassava.

- Exemption from corporate income tax for 5 years.

- Exemption of import duties on new machinery.

- Exemption of import duties on raw materials used in production for export.

- 100% foreigner ownership.

- Permit to own land.

- Permit to bring in skilled workers and experts to work in the Kingdom.

Contact MSNA Group to set up your BOI company in Thailand now.