Who wants a Tax Residence Certificate or “Certificate of Residence”? Simply put, the foreigners who want to show it to their home country to prove that they should pay tax to Thailand and not their home country. Tax residence certificate may be issued by the Thai Revenue Department upon request by a foreigner who stayed in the country for 180 days or more in a calendar year. If you were in Thailand for such a period in many years, you need a Tax residence certificate for each year. Not one certificate is good for various years. By the way, do not confuse it with a Tax Clearance Certificate or an Income Tax Payment Certificate.

A company registered in Thailand may also request a tax residence certificate. However, here we want to talk only about individuals who may want to obtain one. MSNA Group can assist you in getting it issued by the Thai tax authorities. The two most important things are:

- You need to be able to prove that you were in Thailand (continuously or not) at least 180 days in the year by showing the copy of your passport pages where there are stamps of your entries and exits.

- You need to have income earned in that year and brought into Thailand the same year, or you were working in Thailand with a work permit. This way, you would file your personal income tax of that year. The Revenue Department needs to see your tax return with its official receipt and your Tax ID card.

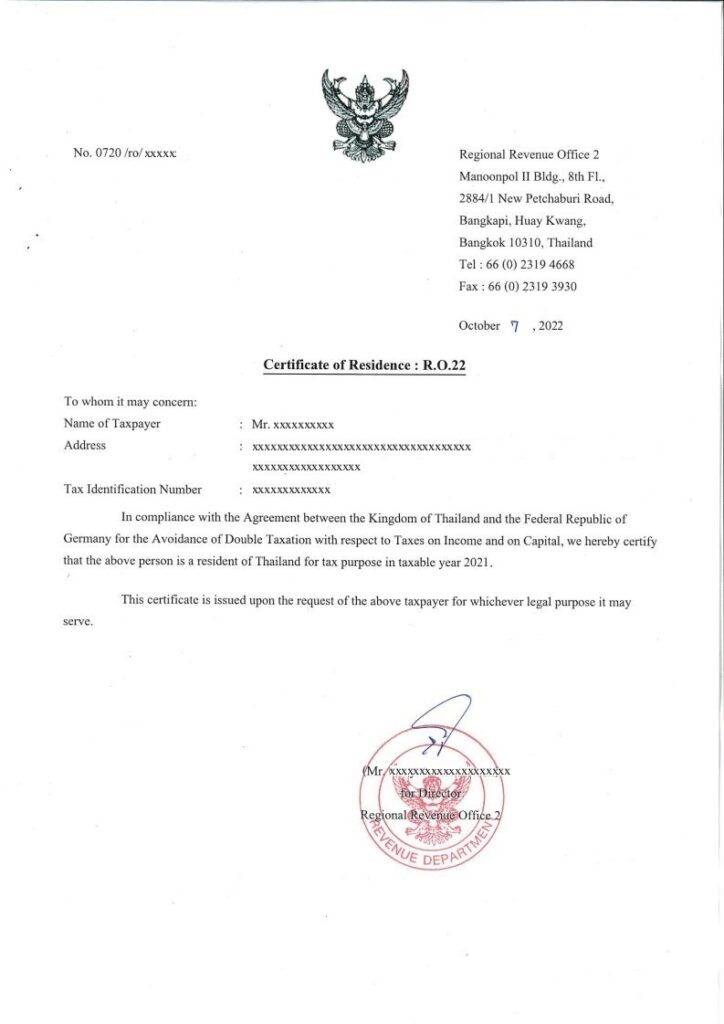

Just contact MSNA Group so we can help you obtain your Tax ID card, prepare and file your tax return, get an Income Tax Payment Certificate or a Tax Clearance Certificate or a Tax Residence Certificate (which the Revenue Department calls “Certificate of Residence”). Essentially, the document looks like this: