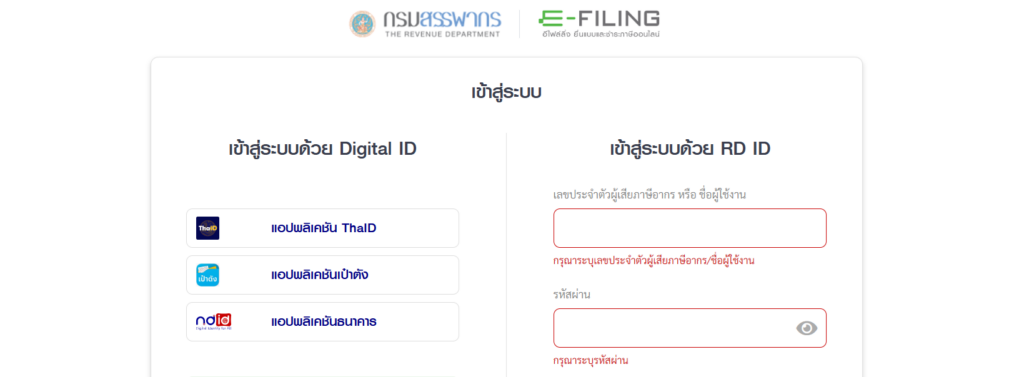

MSNA can assist you on how your company can file taxes online. If you are not registered with online tax filing yet, we can register your company with the Revenue Department’s e-filing system.

The RD’s e-filing system offers filing and submission services via the Internet which can be filed by taxpayers and accounting offices like MSNA. The e-filing system can also support the filing of all types of taxes, both regular and additional within the deadline and after the deadline.

The types of taxes that can be filed via e-filing system are as follow: –

- Personal income tax

- Corporate income tax

- Value Added Tax (VAT)

- Specific Business Tax

- Withholding tax

- Revenue Stamp

- Inheritance tax

- Foreign Income Notification Form

Users of e-filing system: –

- Taxpayers in Thailand

- Accountants or service providers, who act as tax agents and submit the tax returns and pay taxes on behalf of the taxpayers or customers

In the case of tax filing at different times:

- Both regular tax returns and additional forms submitted within the filing deadline

- Filing a regular form or additional forms after the filing deadline will incur additional charges, fines and criminal penalties

To ensure you submit your Thai taxes accurately and seamlessly, consult with us now for proper guidance and tax advice.